Creating value

Community Users

Support languages

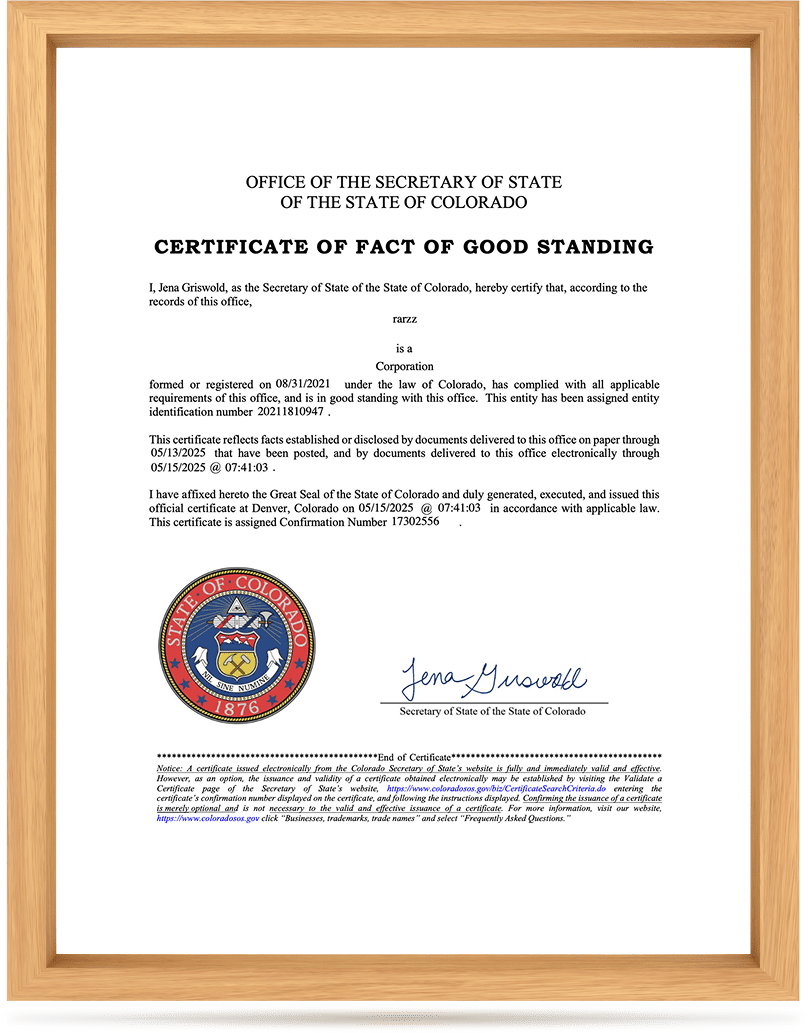

Rarzz was founded by a team with international vision and cross-domain backgrounds, headquartered in Seattle, USA. Team members come from various fields including financial engineering, blockchain development, AI algorithm research, and product operations, with extensive experience in global financial markets and technology platform construction.

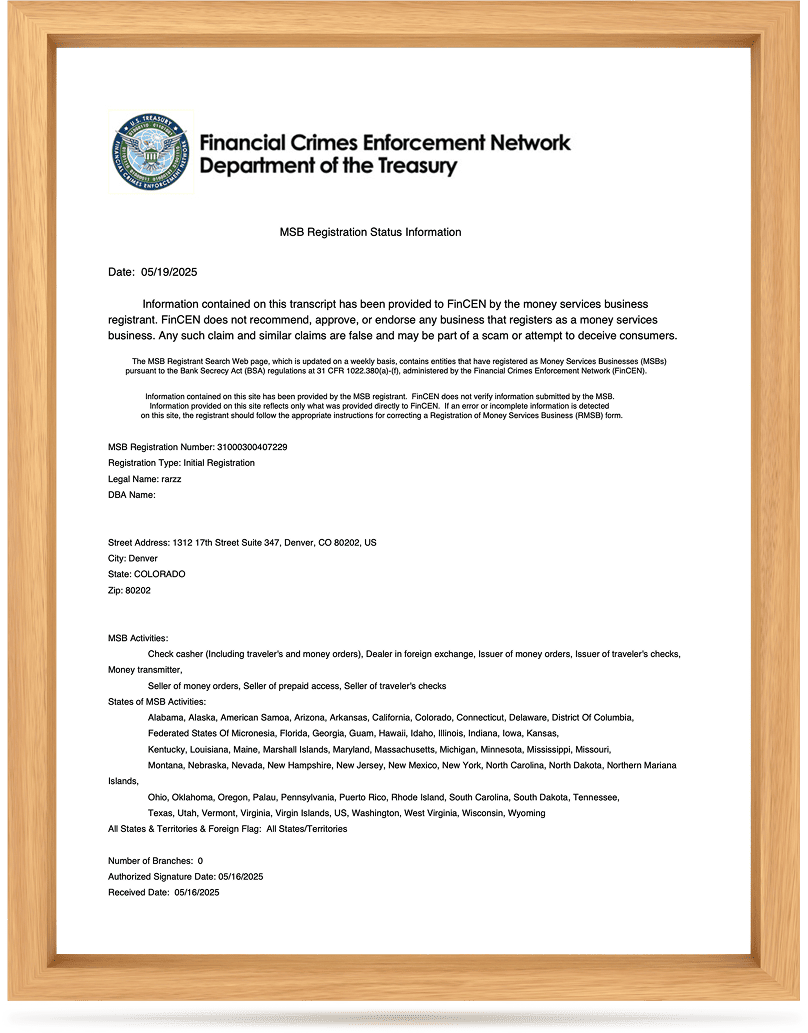

The platform's operating entity has obtained the MSB (Money Services Business) financial service license issued by the U.S. FinCEN, possessing the legal compliance qualifications to provide digital asset management, transaction matching, and NFT financial services.

AI Dynamic Valuation Engine:

Based on machine learning models, it evaluates NFT market value, price trends and position risks in real time.

Intelligent Risk Control System:

Built-in asset rating, strategy blacklist, and user behavior monitoring mechanisms effectively prevent malicious operations and systemic risks.

Plug-in Contract Structure:

All platform functional modules are independently deployed in the form of smart contracts to achieve rapid upgrades and security isolation.

Cross-chain Communication Protocol:

Using lightweight verification mechanisms to achieve multi-chain asset mapping and contract linkage (compatible with Ethereum / BSC / Polygon / Solana, etc.)